Around 1.5 million new units were completed across the U.S. in March 2025 alone, according to the U.S. Census, and with them, the real estate world continues to grow. As the landscape of real estate development evolves, so do the strategies investors can use to build successful property portfolios.

Whether you're a seasoned investor or just beginning your journey, understanding the nuances of real estate development investing is crucial for achieving substantial returns.

In this article, we reveal strategies that enhance your approach to real estate development. Learn how to navigate the complexities of buying off-plan and leverage real estate development finance to maximize returns. With these insights, you'll discover how to build a robust property portfolio that delivers strong returns on investment.

Understanding Real Estate Development

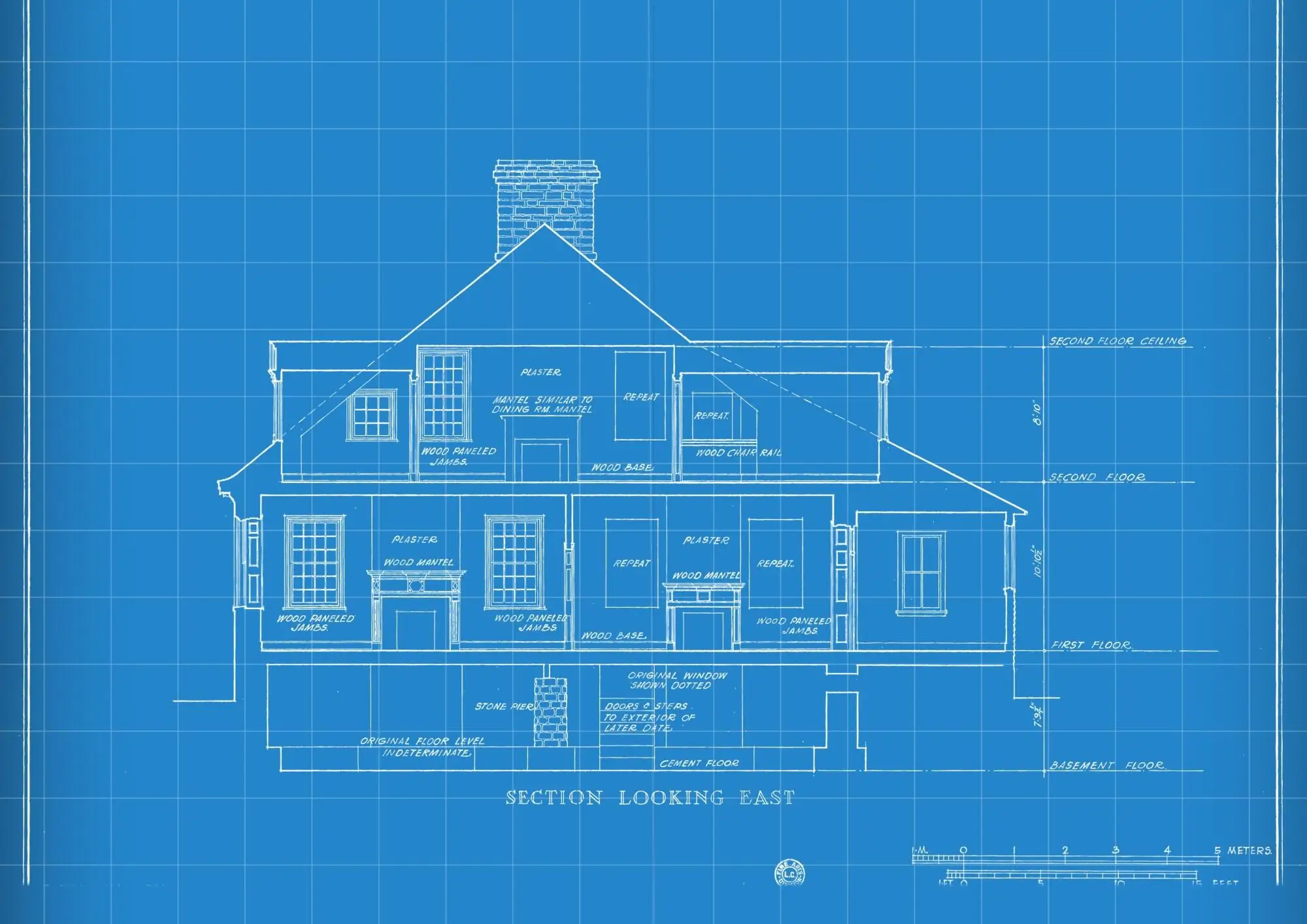

Real estate development encompasses the entire process of buying land, designing, constructing, and ultimately selling or leasing properties for profit. In today's fast-paced economy, the demand for innovative, sustainable spaces continues to grow, making it an opportune time for investors.

Successful real estate developments can yield impressive returns, but they require a combination of:

- Market knowledge

- Financial acumen

- Strategic planning.

Strategic Investing: Buying Off-Plan

One of the smart strategies in real estate development is buying off-plan. Doing this involves purchasing properties before they are constructed, often while still in the design phase.

The benefits of this approach can be significant, as property values typically increase by the time the project finishes. However, conducting thorough research on the developers' track records and the location's growth potential is essential to mitigate risks.

Research: Look for areas projected for growth, such as those with new infrastructure or amenities.

Developer credentials: Evaluate the previous successful projects completed by the developer.

Negotiation: Take advantage of potential discounts offered by developers to early buyers.

Financing Your Real Estate Development

Real estate development finance is a critical aspect that can make or break your project. After all, as MoneyGeek states, few investment opportunities compare to the 80% financing of property investment.

Securing the right funding sources can enhance your investment's viability. Here are some avenues to explore:

Conventional lending: Traditional banks can provide loans based on property appraisals.

Personal investment: Utilizing your funds can reduce dependency on lenders and increase profit margins.

Joint ventures: Partnering with other investors can increase capital and share risks.

Real Estate Development Moving Forward

Looking ahead, the trends in real estate point towards a growing emphasis on sustainability and technology integration. Developers focused on successful real estate developments incorporate green building practices and smart technologies to attract discerning buyers. Investors should monitor how these factors can influence real estate return on investment and ultimately dictate market demand.

Building a Better Property Portfolio

Successfully navigating the real estate development landscape requires informed strategies to maximize returns on investment. For example, you can leverage expert insights to shape your property portfolio by partnering with a dedicated asset management firm.

PMI Charlotte excels in professional property management, utilizing cutting-edge technology to offer real-time access to investment performance. Our team understands the nuances of ownership and works diligently to enhance your assets while ensuring compliance with all regulations.

Talk to us to explore how we can tailor our services to meet your specific needs and drive your success in real estate development.